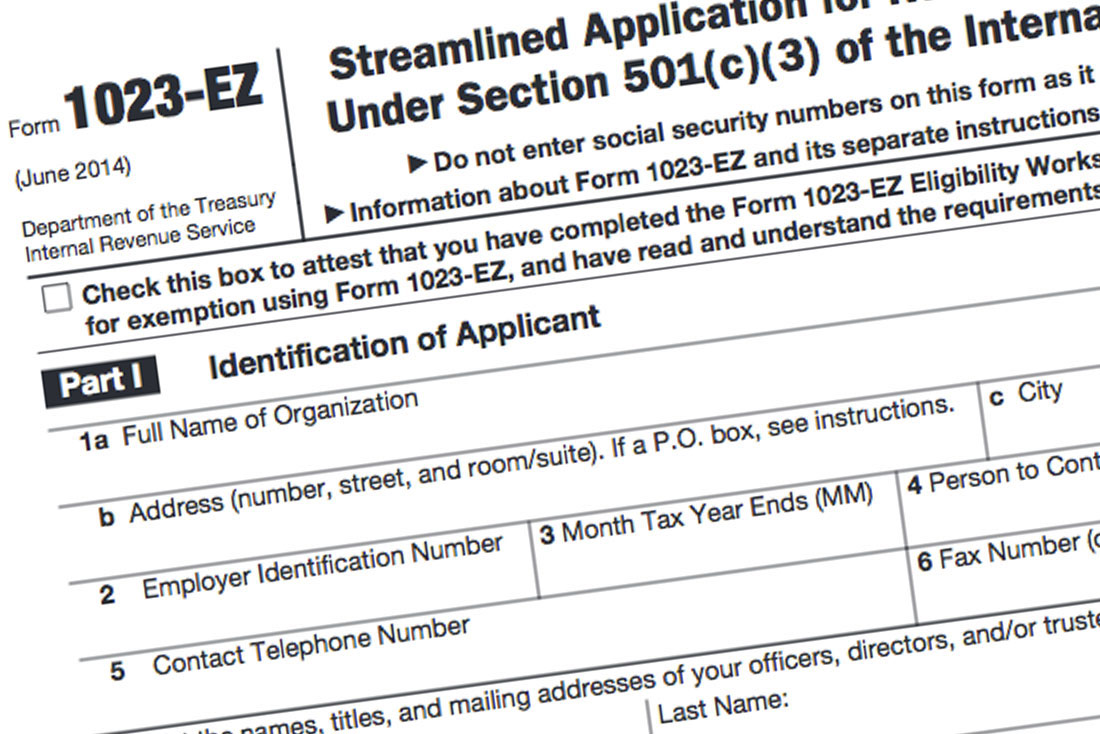

Form 1023-EZ: The Faster, Easier 501(c)(3) Application for Small Nonprofits

Learn what 501(c)(3) status is and how Form 1023-EZ can help your nonprofit obtain tax benefits faster and easier.

Great news for new small nonprofits – the IRS recently streamlined the process of applying for 501(c)(3) status by introducing Form 1023-EZ. The new form applies to certain small organizations seeking federal tax exemption under Internal Revenue Code (“IRC”) § 501(c)(3), and reduces the application down to three pages instead of the full 31-page Form 1023.

What is 501(c)(3) Status?

When you start a nonprofit organization, regardless of whether you formally incorporate with your state, you are creating a legal entity that is subject to federal tax regulations.

The IRS has determined that certain nonprofit organizations should be exempt from some federal income taxes. Specifically, IRC § 501(c) lists 26 types of exempt organizations. The third category on the list, 501(c)(3), is for nonprofit organizations that are organized and operated exclusively for charitable, scientific, literary, religious, or educational purposes.

These types of organizations are able to accept contributions and donations that are tax-deductible to the donor, and apply for grants and other public or private financial allocations available only to IRS-recognized 501(c)(3) organizations. However, an organization generally must apply for recognition under 501(c)(3). This is where Form 1023 and 1023-EZ come in.

Form 1023-EZ

Up until the summer of 2014, most nonprofit organizations seeking tax exemption under 501(c)(3) had to file Form 1023, which requires a substantial amount of input from the applicant, including a written narrative, financial data, and specific organizational documents. On top of that, applicants typically had to wait six months or more to have the application processed by the IRS.

Form 1023-EZ, however, provides a faster and easier method of obtaining 501(c)(3) status. The form is significantly shorter and does not require a narrative description or other documents, and the cost and approval time are reduced as well.

As of this article, Form 1023-EZ has a filing fee of $400.00 and can be approved in as fast as one month. Compare that to the full Form 1023, which costs up to $850.00 and can take six or more months to be approved.

Requirements

Only certain nonprofit organizations are able to obtain 501(c)(3) recognition through Form 1023-EZ. Before completing Form 1023-EZ, applicants are required to complete an eligibility worksheet that asks 26 “yes or no” questions about the applying organization. Applicants must be able to answer “no” to all questions in order to qualify. Fortunately, the questions are favorable for many small nonprofits.

The first few questions are the most relevant to small nonprofits since they ask about the financial size of the organization. The questions ask whether the organization anticipates its annual gross receipts to be more than $50,000 in any of the next 3 years, had annual gross receipts over $50,000 in any of the past 3 years, or has assets exceeding a fair market value of $250,000. If you can answer “no”, then Form 1023-EZ might be for you.

Other Considerations

While Form 1023-EZ greatly reduces the burden of seeking 501(c)(3) status, there are some possible shortcomings:

First, nonprofit organizations can and should actually attempt to make a profit in order to better fulfill their missions. Consequently, an organization that originally qualified as tax exempt under 501(c)(3) by filing Form 1023-EZ may find itself grossing more than $50,000 in a year. This creates the possibility of being audited by the IRS. While good record keeping should avoid any issues, organizations can preemptively avoid the $50,000 threshold by using the full Form 1023.

Second, Form 1023-EZ’s lack of a requirement for documents may not always be beneficial since some nonprofit organizations have complicated structures and programs that need to be explained to the IRS. Form 1023-EZ does not allow for these explanations but Form 1023 gives an organization space to explain its operations.

Take Away

Form 1023-EZ provides an excellent opportunity for small nonprofits to gain the benefits of tax exemption under IRC § 501(c)(3). With a reduced time and financial burden, many nonprofit organizations will find this form a welcomed addition.

Notice: This post is for informational purposes only and is not a substitute for professional advice based on a review of individual circumstances. Please contact an attorney regarding your particular legal issues.

The Consequences of Collaboration

Learn how collaboration affects your rights as a copyright owner.

We’re sometimes approached by artists who have undertaken a project with collaborators that have been asked to help the artist achieve their vision. However, the collaborators hadn’t worked out ahead of time who will own the resulting copyright and plunge into the project, or they have only the loosest agreement. By the time we see them, they’re trying to sort out who owns the resulting rights and may even be in the midst of an acrimonious dispute. The good news is that many ownership disputes can easily be avoided by having a written agreement in place prior to the project’s start.

A prime example is a musician who has composed a piece and wants to record a demo for purposes of shopping the demo to a record label or the underlying composition to a publisher. As part of that, the musician has sought out an engineer or perhaps other musicians to assist in the recording process.

Will the collaborators have any copyright ownership interest in the composition or resulting sound recording? In the absence of an employee/employer relationship (which will not be addressed here) or agreement to the contrary, the answer could very well be “yes”.

Copyright Law

Would-be authors, regardless of artistic discipline, should be aware of when and how copyrights come into existence. Copyright automatically attaches when a creative work is fixed in a tangible medium of expression. That is, the work is no longer just an idea in the author’s head and has been committed to a format viewable by the unaided eye or with the aid of a machine. Nothing additional is required of the author.

Ownership of the copyright is fixed with the author at the same time the work is made. If more than one person contributed to creation of the work, ownership will be held jointly amongst all of the co-creators.

Legal Effects of Collaboration

In the absence of an agreement that states otherwise, any artistic contributions made to either the composition or sound recording by the collaborators would make them co-authors and joint owners of any copyrights to which they’ve contributed. This could be as simple as modifications to the melody or lyrics, the addition of a solo, or production choices made during the recording process.

So what does this mean for our musician/composer? As a co-owner of the demo recording, the collaborators would be free to make use of the materials as they see fit, other than to assign or exclusively license the copyright to another party. Further, if our solo musician plays the demo for a record label and the label decides to re-record the composition, collaborators on the composition would have an interest in the resulting royalties.

Obviously, this would be a disaster for a young solo musician as they’ve lost artistic control of what was originally their work or are splitting royalties with collaborators when they didn’t intend to. So what’s the best way to avoid these worst case scenarios?

Avoiding Co-Ownership

To that end, our musician has a couple of options to maintain ownership from the outset of the project: (1) record the demo by themselves or (2) put in place an agreement with collaborators that all of their contributions are owned by the musician.

To avoid any issues, it’s best to have a written agreement in situations where you want to completely own the final product without question or subject to outside claims. Ideally, any artist preparing to undertake a collaborative project should consult put in place an agreement assuring full ownership of the resulting works.

If an artist has already completed a project with collaborators and no agreement was in place, they should immediately try to sort out issues of ownership. In either case, it’s best to consult with an experienced attorney who can guide the process.

Notice: This post is for informational purposes only and is not a substitute for professional advice based on a review of individual circumstances. Please contact an attorney regarding your particular legal issues.

Negotiating Contract Terms: Kill Fees

Learn how kill fees and other terms in your client contract can be used to your advantage during negotiations.

Aspect Law Group is collaborating with Design Week Portland for a column called "Creatives Ask a Lawyer". Head over here to find out more. Q: “What is the recommended kill fee for independent contractors to put in their client contracts?”

You can read the full post and answer to this question on the Design Week Portland tumblr.

This is a great questions because it touches on several topics. In the post, I cover the importance of a contract, contract terms such as kill fees and alternatives, and negotiating contracts.

Thanks for the question!

Notice: This post is for informational purposes only and is not a substitute for professional advice based on a review of individual circumstances. Please contact an attorney regarding your particular legal issues.

Logos: to Inc. or not to Inc.

Learn how trademark law and business law affects you and your client when designing logos.

Aspect Law Group is collaborating with Design Week Portland for a column called "Creatives Ask a Lawyer". Head over here to find out more. Q: "Do logos need to display ‘Inc’ or ‘LLC’? I have a client that has been told by his lawyer that his logo has to have ‘Inc’ somewhere in it. I have run into this many times, as well as clients insisting that they have to have the ‘LLC’ in the logo. All the information on the web says that it is not needed on the actual logo, but must be on trademark and corporate filings."

You can read the full post and answer to this question on the Design Week Portland tumblr.

In the post, I cover trademark law basics, business law, and general business practices issues. The short answer is that logos do not need to have the business designation but certainly can, and business should use their full legal name when conducting business.

Thanks for the question!

Notice: This post is for informational purposes only and is not a substitute for professional advice based on a review of individual circumstances. Please contact an attorney regarding your particular legal issues.

Creatives Ask a Lawyer

Aspect Law Group is working with Design Week Portland to bring you “Creatives Ask a Lawyer”!

Aspect Law Group is working with Design Week Portland to bring you "Creatives Ask a Lawyer"! From DWP:

Do you know when you need a contract? Or how to register a trademark? Bryan Wasetis from Aspect Law Group works primarily with artists, designers, and makers on issues we face, like licensing and protecting intellectual property.

He's here to answer all of your burning legal questions and will be working a few responses into a column on our blog.

You can send us questions through Twitter or email.

Keep an eye out for our answers!